- Financials

- Shareholder Services

- Corporate Governance

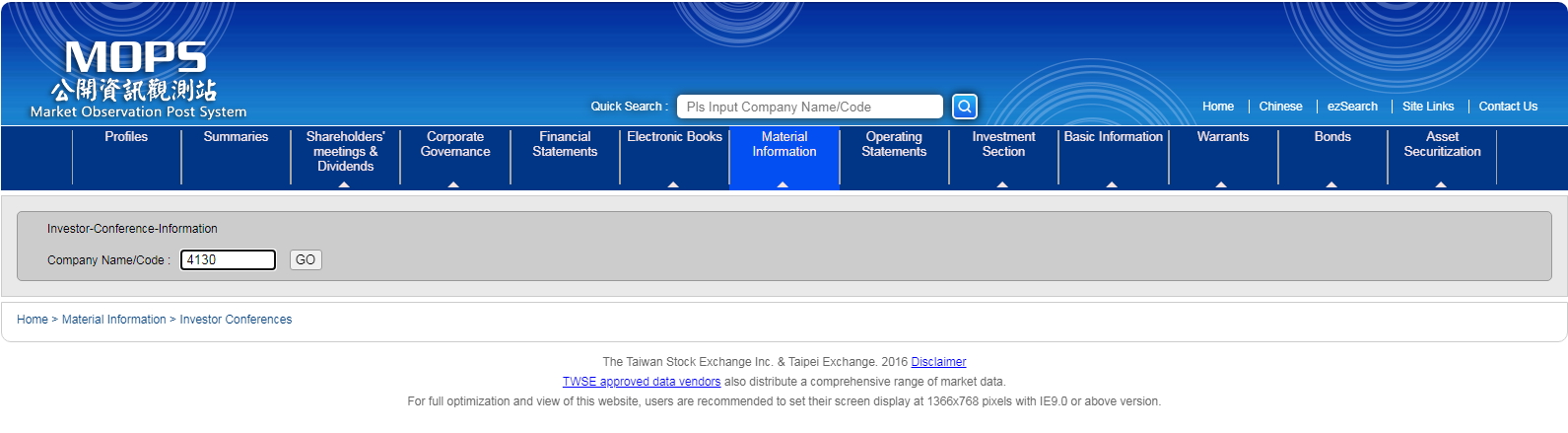

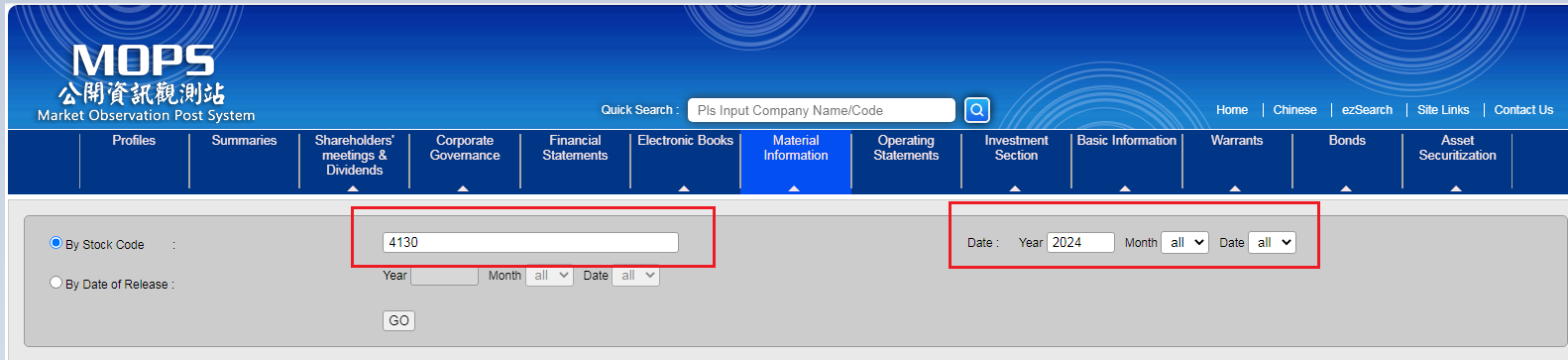

- Investor Conference

- Material Information

- Investor Relations & Media Contact

Tip’s:Year(2023)…Quick search。

| Year | Operating revenue(NT$ thousands) | Annual increase (decrease) percentage (%) |

|---|---|---|

| 2024 Total | 266,259 | -2.11% |

| 2024/12 | - | - |

| 2024/11 | - | - |

| 2024/10 | - | - |

| 2024/09 | - | - |

| 2024/08 | - | - |

| 2024/07 | - | - |

| 2024/06 | 42,158 | -10.53% |

| 2024/05 | 44,656 | -11.81% |

| 2024/04 | 40,086 | -6.07% |

| 2024/03 | 51,064 | -2.22% |

| 2023/02 | 32,081 | -10.50% |

| 2024/01 | 56,214 | 29.20% |

| 2023 Total | 528,512 | 20.46% |

| 2023/12 | 33,939 | 19.91% |

| 2023/11 | 41,188 | -4.64% |

| 2023/10 | 44,320 | 1.21% |

| 2023/09 | 44,736 | 20.41% |

| 2023/08 | 47,136 | 21.34% |

| 2023/07 | 45,187 | 14.83% |

| 2023/06 | 47,122 | 23.08% |

| 2023/05 | 50,634 | 40.90% |

| 2023/04 | 42,675 | 24.66% |

| 2023/03 | 52,221 | 48.46% |

| 2023/02 | 35,846 | 34.82% |

| 2023/01 | 43,508 | 14.79% |

| 2022Total | 438,759 | 1.04% |

| 2022/12 | 28,303 | -30.23% |

| 2022/11 | 43,194 | 14.48% |

| 2022/10 | 43,790 | 29.00% |

| 2022/09 | 37,153 | -5.94% |

| 2022/08 | 38,846 | -5.55% |

| 2022/07 | 39,350 | 4.79% |

| 2022/06 | 38,287 | 18.41% |

| 2022/05 | 35,936 | -2.67% |

| 2022/04 | 34,234 | 10.33% |

| 2022/03 | 35,175 | 0.69% |

| 2022/02 | 26,589 | 16.36% |

| 2022/01 | 37,902 | -17.18% |

| 2021 Total | 434,254 | -8.14% |

| 2021/12 | 40,565 | 65.50% |

| 2021/11 | 37,730 | 51.95% |

| 2021/10 | 33,946 | -19.39% |

| 2021/09 | 39,498 | -4.48% |

| 2021/08 | 41,129 | 16.39% |

| 2021/07 | 37,553 | -16.01% |

| 2021/06 | 32,335 | -30.28% |

| 2021/05 | 36,920 | -5.30% |

| 2021/04 | 31,028 | -19.76% |

| 2021/03 | 34,934 | -25.63% |

| 2021/02 | 22,851 | -44.31% |

| 2021/01 | 45,765 | -4.32% |

| 2020 Total | 472,723 | 1.50% |

| 2020/12 | 24,511 | -24.06% |

| 2020/11 | 24,831 | -36.95% |

| 2020/10 | 42,114 | 22.66% |

| 2020/09 | 41,351 | 5.45% |

| 2020/08 | 35,338 | 6.82% |

| 2020/07 | 44,710 | 18.24% |

| 2020/06 | 46,378 | 25.17% |

| 2020/05 | 38.988 | -5.75% |

| 2020/04 | 38,667 | 7.78% |

| 2020/03 | 46,974 | 19.24% |

| 2020/02 | 41,029 | 27.57% |

| 2020/01 | 47,832 | -25.03% |

| 2019 Total | 465,756 | 2.18% |

| 2019/12 | 32,278 | 2.19% |

| 2019/11 | 39,383 | 4.08% |

| 2019/10 | 34,335 | -15.23% |

| 2019/09 | 39,213 | 9.71% |

| 2019/08 | 33,082 | -11.39% |

| 2019/07 | 37,814 | 9.75% |

| 2019/06 | 37,053 | -0.67% |

| 2019/05 | 41,368 | 3.62% |

| 2019/04 | 35,875 | 5.75% |

| 2019/03 | 39,393 | 5.98% |

| 2019/02 | 32,161 | -2.76% |

| 2019/01 | 63,802 | 12.04% |

| 2018 Total | 455,798 | 11.64% |

| 2018/12 | 31,586 | 7.01% |

| 2018/11 | 37,838 | 12.56% |

| 2018/10 | 40,504 | 19.19% |

| 2018/09 | 35,742 | -4.76% |

| 2018/08 | 37,335 | 4.23% |

| 2018/07 | 34,455 | 12.79% |

| 2018/06 | 37,302 | -0.23% |

| 2018/05 | 39,922 | 8.20% |

| 2018/04 | 33,924 | 8.77% |

| 2018/03 | 37,169 | 1.60% |

| 2018/02 | 33,073 | 19.40% |

| 2018/01 | 56,948 | 51.70% |

| 2017 Total | 411,203 | -0.71% |

| 2017/12 | 29,518 | -23.12% |

| 2017/11 | 33,615 | 10.25% |

| 2017/10 | 33,984 | 7.76% |

| 2017/09 | 37,528 | 9.37% |

| 2017/08 | 35,782 | -2.97% |

| 2017/07 | 30,548 | -26.06% |

| 2017/06 | 37,388 | 2.37% |

| 2017/05 | 36,895 | 17,11% |

| 2017/04 | 31,190 | 1.10% |

| 2017/03 | 36,584 | 5.48% |

| 2017/02 | 27,700 | -0.69% |

| 2017/01 | 37,539 | 1.95% |

| 2016 Total | 411,203 | -13.90% |

| 2016/12 | 38,397 | -11.13% |

| 2016/11 | 30,490 | -26.09% |

| 2016/10 | 31,538 | -27.28% |

| 2016/09 | 34,313 | -15.35% |

| 2016/08 | 36,876 | -5.93% |

| 2016/07 | 41,346 | 12.32% |

| 2016/06 | 36,521 | 6.04% |

| 2016/05 | 31,505 | -17.07% |

| 2016/04 | 30,851 | -13.25% |

| 2016/03 | 34,683 | -2.97% |

| 2016/02 | 27,892 | -22.14% |

| 2016/01 | 36,821 | -31.41% |

| 2015 Total | 477,596 | 0.45% |

| 2015/12 | 43,208 | 35.19% |

| 2015/11 | 41,253 | 23.42% |

| 2015/10 | 43,372 | 10.59% |

| 2015/09 | 40,536 | -0.48% |

| 2015/08 | 39,201 | -4.93% |

| 2015/07 | 36,783 | -21.55% |

| 2015/06 | 34,440 | 1.00% |

| 2015/05 | 37,991 | -19.70% |

| 2015/04 | 35,564 | -7.86% |

| 2015/03 | 35,745 | -7.94% |

| 2015/02 | 35,823 | 16.83% |

| 2015/01 | 53,680 | 2.25% |

| 2014 Total | 475,450 | 19.75% |

| 2014/12 | 31,962 | 10.89% |

| 2014/11 | 33,426 | 7.98% |

| 2014/10 | 39,217 | 18.71% |

| 2014/09 | 40,731 | 17.73% |

| 2014/08 | 41,234 | 25.64% |

| 2014/07 | 46,888 | 16.22% |

| 2014/06 | 34,098 | 19.51% |

| 2014/05 | 47,309 | 38.36% |

| 2014/04 | 38,597 | 14.80% |

| 2014/03 | 38,826 | 13.07% |

| 2014/02 | 30,663 | 25.75% |

| 2014/01 | 52,499 | 26.81% |

| 2013 Total | 397,042 | 13.06% |

| 2013/12 | 28,822 | -3.17% |

| 2013/11 | 30,956 | 27.94% |

| 2013/10 | 33,037 | 37.19% |

| 2013/09 | 34,597 | 6.44% |

| 2013/08 | 32,818 | 15.69% |

| 2013/07 | 40,345 | 36.80% |

| 2013/06 | 28,532 | -6.51% |

| 2013/05 | 34,192 | 9.32% |

| 2013/04 | 33,620 | 27.22% |

| 2013/03 | 34,339 | 9.74% |

| 2013/02 | 24,384 | -11.09% |

| 2013/01 | 41,400 | 15.51% |

| 2012 Total | 351,187 | 5.99% |

| 2012/12 | 29,765 | 21.92% |

| 2012/11 | 24,195 | -7.01% |

| 2012/10 | 24,082 | 20.55% |

| 2012/09 | 32,505 | 11.42% |

| 2012/08 | 28,368 | 3.32% |

| 2012/07 | 29,492 | 9.59% |

| 2012/06 | 30,518 | 8.70% |

| 2012/05 | 31,277 | -13.73% |

| 2012/04 | 26,427 | -0.85% |

| 2012/03 | 31,290 | 2.78% |

| 2012/02 | 27,427 | 27.56% |

| 2012/01 | 35,841 | 4.00% |

|

||||||

Our dividend policy is formulated based on operational strategies, short, medium, and long-term investment plans, capital budgeting, and changes in internal and external environments. It is aligned with the profitability for the year, and the Board of Directors proposes a distribution plan which is subsequently approved by the shareholders’ meeting. The distribution follows a balanced principle, ensuring that at least fifty percent of the distributable earnings for the year are allocated as dividends to shareholders, with a minimum of ten percent in cash dividends. |

||||||

|

||||||

Year |

Shareholders’ Meeting Date |

Dividend per Share

(Common Stock) |

Ex-Rights Date |

Ex-Dividend Date |

Dividend Payment Date |

|

Cash Dividend

|

Stock Dividend

|

|||||

2023 |

2024/05/31 |

0.150 |

0.3 |

2024/08/21 |

2024/08/21 |

2024/09/25 |

2022 |

05/29/2023 |

0.175 |

0 |

07/14/2023 |

07/14/2023 |

08/04/2023 |

2021 |

05/31/2022 |

0.35 |

0 |

07/26/2022 |

07/26/2022 |

08/18/2022 |

2020 |

8/10/2021 |

0.41 |

0.2 |

9/18/2021 |

9/18/2021 |

10/15/2021 |

2019 |

5/29/2020 |

0.465 |

0.2 |

8/31/2020 |

8/31/2020 |

9/28/2020 |

2018 |

5/30/2019 |

0.5 |

0.3 |

7/23/2019 |

7/23/2019 |

8/21/2019 |

2017 |

5/30/2018 |

0.8 |

0 |

– |

7/12/2018 |

8/3/2018 |

2016 |

6/23/2017 |

0.3522 |

0 |

– |

8/2/2017 |

8/25/2017 |

2015 |

5/30/2016 |

0.5 |

0 |

– |

7/12/2016 |

8/5/2016 |

2014 |

6/2/2015 |

0.5 |

0 |

– |

7/13/2015 |

7/31/2015 |

2013 |

6/10/2014 |

0.3 |

0 |

– |

7/18/2014 |

8/4/2014 |

2012 |

6/24/2013 |

0.3 |

0 |

– |

7/16/2013 |

8/6/2013 |

Shareholders Meeting

Date |

Meeting Notice |

Agenda Handbook |

Annual Report |

Meeting Minutes |

2024/05/31 |

Download |

Download |

Download |

Download |

2023/05/29 |

Download |

Download |

Download |

Download |

Shareholders Meeting Video Materials

Shareholders’ Meeting Date |

Video |

2024/05/31 |

Click(外部連結) |

2023/05/29 |

Click(外部連結) |

Stock Transfer Agent

Name: |

Capital Securities Corporation |

Address: |

B2F., No.97, Sec. 2, Dunhua S. Rd., Da’an Dist., Taipei |

Tel: |

(02)2702-3999 |

Website: |

http://www.capital.com.tw/ |

- Corporate Governance Organizational Structure

- Corporate Governance Practices

- Board

- Committee

- Internal Audit

- Major Company Policies

In “Procedures for Election of Directors and Supervisors,” the company clearly stipulates the principle of diversification of the board of directors, strengthens corporate governance, and promotes the sound development of the board’s composition and structure. Directors are elected and nominated through a candidate nomination system. After the board of directors passes the resolution, they are submitted to the shareholders’ meeting for selection. To formulate an appropriate diversification policy based on its own operations, business model, and development requirements, it should include, but not be limited to, the two major aspects of the standard listed below:

(i) Fundamental qualities and values: gender, age, nationality, and culture, etc.

(ii) Professional knowledge and abilities: professional background (such as law, accounting, industry, finance, marketing, or technology), professional skills, industrial experience, business management, an international perspective, management and decision-making skills, etc.

Board Member |

|||

Title |

Name |

Experience (Education) |

Other Position |

Chairman |

Chen, Jen |

.Ph.D. in Chemistry, University of Rochester, USA.Novartis Program Host.Genelabs, Vice Chairman of Asia Sales.QPS-Qualitix Clinical Research Co., Ltd., Chairman.Bio Taiwan Committee (BTC), Executive Yuan, Committee Member |

.Genovate Biotechnology Co., Ltd., Chairman and CSO.Quest Pharmaceutical Services Taiwan Co., Ltd., Corporate Representative (Director).Genovate Biotechnology (Cayman) Co., Ltd., Corporate Representative (Director).Unipharma Co. Ltd., Chairman and CSO.Reber Genetics Co., Ltd., Corporate Representative (Director).NaviFUS Corporation, corporate representative (Chairman) and CSO.Genovate NaviFus (Australia)Pty. Ltd., Corporate Representative (Director).Savior Lifetec Corporation, Corporate Representative (Director) |

Director |

Chen, Hsiu-Hui |

.Ph.D. Department of Agricultural Chemistry, NTU.Head of CEO Office and Planning and Examination Office, Research Fellow of R&D Division, Development Center for Biotechnology.Research Fellow, Yi Cheng Biotech.Postdoctoral Fellow, Academia Sinica |

.Associate Executive Officer, Development Center for Biotechnology.Corporate Representative (Director), EirGenix Inc. |

Director |

Huang, Chi-Ying |

.Ph.D. Department of Biochemistry, Biophysics, Iowa State University.Director, PharmaEngine Inc..Associate Research Fellow, National Health Research Institutes.Postdoctoral Fellow, Dept. of Chemical & Systems Biology, Stanford University |

.Distinguished Professor and Director, Department of Pharmacy, National Yang Ming Chiao Tung University.Associate Director, Department of Pharmacy, National Yang Ming Chiao Tung University.Director, Chong Hin Loon Memorial Cancer and Biotherapy Research Center, National Yang Ming Chiao Tung University.Jointly-Appointed Professor, Department of Biochemistry, Kaohsiung Medical University.Corporate Representative (Director), Intech Biopharm. Ltd. |

Director |

Chu, Chia-Chen |

.Master’s Degree, Science in Health Policy and Management, Harvard University.Ministry of Health and Welfare, Associate Researcher.Genovate Biotechnology Co., Ltd., Director of International Affairs.Genovate Biotechnology Co., Ltd., New Drug Development Department, Vice President |

.Genovate Biotechnology Co., Ltd., General Manager.Unipharma Co. Ltd., Corporate Representative (Director).NaviFUS Corporation, Corporate Representative (Director).Genovate NaviFus Inc., Corporate Representative (Director).Genovate NaviFus (Australia)Pty.Ltd., Corporate Representative (Director) |

Independent Director |

Lee, Shih-Jen |

.Ph.D. in Chemistry, University of South Carolina.Easywell Biomedicals, Inc., Chairman.Haoli Biotechnology Management Consulting Co., Ltd., Managing Director.Heyu Management Consulting Co., Ltd., Investment Director.Silver Biotech Management, Inc. Managing Director.China Development Industrial Bank Senior Associate of Investment Department |

.TAHO Pharmaceuticals Ltd., Chairman.Easywell Biomedicals, Inc., Chairman.Sunko Ink Co., Ltd., Independent Director.Transwell Biotech Co., Ltd., Director.Industrial Technology Investment Co., Ltd., Director.Taimed Biologics Inc., Independent Director.OBI Pharma Inc., Independent Director.Amphastar Pharmaceuticals, Inc., Director.Amphastar Pharmaceuticals, Inc., Director |

Independent Director |

Liu, Ke-Yi |

.Ph.D. in Accounting, Xiamen University.Master of Accounting, University of Illinois.Bachelor of Finance and Taxation, National Chengchi University |

.BDO Taiwan Joint Venture Accountant.First Commercial Bank Corporate Representative (Supervisor).Independent Director, Taiwan Cooperative Financial Holding Co., Ltd. |

Independent Director |

Chang, Chin-Ming |

.Ph.D. in Pharmacy, University of Texas at Austin.Graduated in Department of Pharmacy, National Taiwan University.Senior Executive in Pharmaceuticals, Processing and R&D, Allergan Inc..Senior Research Fellow, Eli Lilly & Company |

.CEO, TaiMed Biologics.Director, Biotheravision Inc..Director, Oukejian Biomedical Technology Co., Ltd. |

Independent Director |

Su, Lai-Shou |

.M.B.A. of University of North Texas, U.S.A..Executive Secretary of National Development Fund.Board Director of Oversea-Chinese Banking Corporation.Board Director of HanTech Venture Capital Corporation.Board Director of Taiwan Aerospace Corporation.Supervisor of Kaohsiung Rapid Transit Corporation.Supervisor of Powerchip Semiconductor Corporation.Supervisor of Mirle Automation Corporation |

.Vanguard International Semiconductor Corporation, Corporate Representative (Director).Taiwan Bio-Manufacturing Corporation, Corporate Representative (Director) |

Audit Committee

Genovate established the Audit Committee in June 2017. The Audit Committee is responsible for the following duties and shall submit its recommendations to the Board of Directors for discussion:

-

Formulating or amending internal control systems in accordance with Article 14-1 of the Securities and Exchange Act.

-

Assessing the effectiveness of internal control systems.

-

Establishing or amending procedures for significant financial transactions involving acquisition or disposal of assets, derivative transactions, loans of funds to others, endorsement for others, or provision of guarantees in accordance with Article 36-1 of the Securities and Exchange Act.

-

Matters involving conflicts of interest of directors themselves.

-

Significant asset or derivative transactions.

-

Significant loans of funds, endorsements, or guarantees.

-

Offering, issuance, or private placement of equity securities.

-

Appointment, dismissal, or compensation of chartered public accountants (CPA).

-

Appointment or removal of heads of finance, accounting, or internal audit.

-

Quarterly and annual financial reports.

-

Other significant matters as required by other companies or competent authorities.

Please refer to Genovate Annual Report for the relevant year for the number of meetings convened and each member’s attendance rate.

Remuneration Committee

The Board of Directors has established the Remuneration Committee in accordance with the Securities and Exchange Act of the Republic of China. As per the regulations, the Remuneration Committee must include at least one independent director as defined by the Securities and Exchange Act. The Remuneration Committee currently consists of three members, all of whom are independent directors.

In accordance with the organizational regulations approved by the Board of Directors, the Remuneration Committee is responsible for establishing and reviewing policies, systems, standards, and structures related to the evaluation of the performance and compensation of directors and executives. The committee also evaluates the remuneration of directors and executives.

The Remuneration Committee convenes regular meetings at least twice a year.

Please refer to Genovate Annual Report for the relevant year for the number of meetings convened and each member’s attendance rate.

Committee Member |

||

Name |

Remuneration Committee |

Audit Committee |

Independent DirectorLee, Shih-Jen |

V(convener) |

V |

Independent DirectorLiu, Ke-Yi |

V |

V(convener) |

Independent DirectorChang, Chin-Ming |

V |

V |

Independent DirectorSu, Lai-Shou |

V |

V |

Internal Audit Organization and Operation

1.Purpose of Internal Audit:

The purpose of internal audit is to assess and examine the effectiveness of internal control systems, the reliability of reporting, compliance with relevant regulations, and to assist the board of directors and management in identifying deficiencies in internal control systems and measuring operational effectiveness and efficiency. It aims to provide timely recommendations to ensure continuous effective implementation of internal control systems and serve as a basis for reviewing and revising these systems.

2.Internal Audit Organization:

The company has established an independent internal audit unit reporting to the board of directors, headed by a Chief Internal Auditor who attends board meetings to report on audit activities. Apart from the appointment and dismissal of the Chief Internal Auditor, which requires approval from the Audit Committee and resolution by the board of directors, other matters such as appointment, evaluation, and compensation of internal audit personnel follow the company’s human resources management procedures, performance assessment methods, and employee compensation distribution rules. These are signed off by the Chief Internal Auditor and approved by the Chairman of the Board. Performance assessments for audit personnel follow the same procedures as for regular employees, involving self-assessment, initial review by the Chief Internal Auditor, and final decision by the Chairman of the Board.

3.Explanation of Internal Audit Operations:

4.Audit Scope: Internal audit activities include examining and evaluating the effectiveness of the internal control system design and execution in various units and subsidiaries of the company.

5.Audit Targets: Audit targets encompass all business responsibilities of the company’s units and subsidiaries.

6.Audit Procedures:

(a)

Annual audit plan: A draft of the annual audit plan is prepared before the end of each year and executed after approval by the board of directors.

(b)

Conducting audit operations: Audits are conducted according to the approved annual audit plan or as per directives from the company’s board of directors or management, specific projects, or business needs.

(c)

Self-inspection operations: Supervising each internal unit and subsidiary to conduct an annual self-inspection of their internal control systems and reviewing their self-inspection reports.

-

Submission and Reporting of Audit Reports:

(a)

After the audit report and follow-up report are reviewed and confirmed, they are submitted for inspection by relevant supervisory authorities by the end of the month following the completion of audit items.

(b)

In case of discovering significant violations or potential significant damage to the company during audit operations, immediate reporting and notification to relevant supervisory authorities are required.

(c)

If there are deficiencies in audit reports, relevant units are requested to cooperate in improvement efforts.

-

Implementation Status of Corrective Actions:

Internal audit personnel regularly prepare follow-up reports on identified deficiencies and anomalies in the internal control system to ensure that appropriate corrective measures have been taken by the relevant units.

-

External Reporting Operations:

In accordance with the “Guidelines for Establishing Internal Control Systems for Publicly Issued Companies,” all required reporting and record-keeping operations are conducted within specified deadlines using the designated internet information system format.

Major Company Policies |

|

1.Articles of Incorporation. |

Download |

2.Operating procedures of endorsement / guarantees. |

Download |

3.Regulations Governing Loaning of Funds. |

Download |

4.Regulations Governing the Acquisition and Disposal of Assets. |

Download |

5.Procedure for Meetings of Board of Directors. |

Download |

6.Procedure for Shareholders Meetings. |

Download |

7.Procedures for Election of Directors. |

Download |

8.Rules Governing the Scope of Powers of Independent Directors. |

Download |

9.Rules Governing the Scope of Powers of Independent Directors. |

Download |

10.Ethical Corporate Management Best Practice Principles. |

Download |

11.Remuneration Committee Charter. |

Download |

12.Procedures for Handling Material Inside Information and the Prevention of Insider Trading. |

Download |

13.Measures for the Report on Illegal, Immoral and Dishonest Acts. |

Download |

14.Procedures for Ethical Management and Guidelines for Conduct. |

Download |

15.Audit Committee Charter. |

Download |

16.Rules for Performance Evaluation of Board of Directors and Functional Committees. |

Download |

17.Corporate Governance Best Practice Principles. |

Download |

Investor Relations & Media Contact

Spokesperson:

Name |

Chiang, Wei-Min |

Title |

Senior Director, Administration Division |

Tel |

02-23211978#2631 |

|

|

williechiang@genovate-bio.com |

Acting Spokesperson:

Name |

Lin, Hui-Ling |

Title |

Vice President, Finance |

Tel |

03-5982221#116 |

|

|

annlin@genovate-bio.com |

Stock Transfer Agent:

Name |

Capital Securities Corporation |

Stock Affair Specialist |

Ms. Chen |

Tel |

(02)2702-3999 |

|

|

a33404@capital.com.tw |

繁體中文

繁體中文